Chairman of the Executive Board

Hannover Re Group

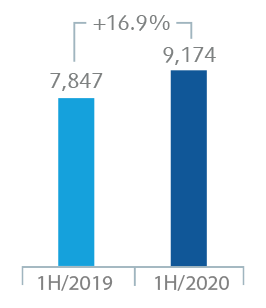

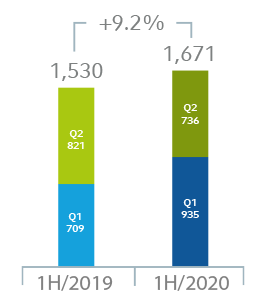

Gross premium

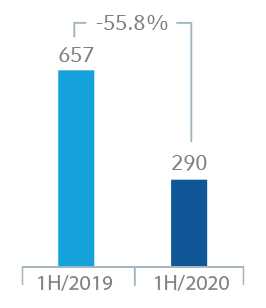

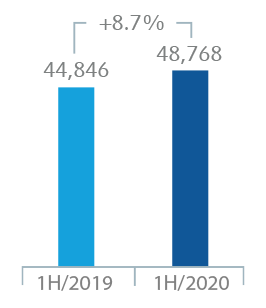

EBIT

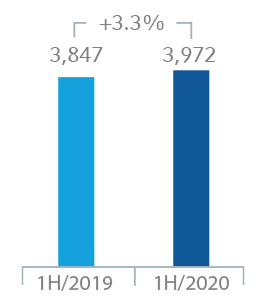

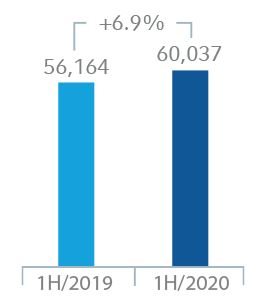

Group net income

Outlook for 2020

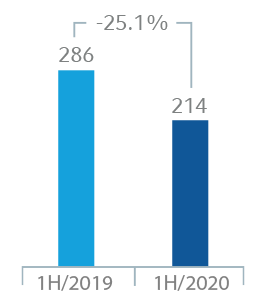

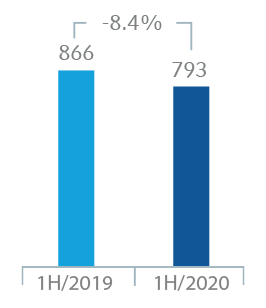

Large loss burden 1H/2020

Net: 737 EUR m.

Our self-image:

somewhat different

Beyond risk sharing - we team up to create opportunities

Together with our customers and partners, we develop value-creating and innovative solutions that deliver lasting protection for companies and individuals worldwide against risk.

Responsibility, we-spirit and drive

are our success factors. Our shared values are the basis for our partnership-based business approach and our long-standing client relationships.

More

Our self-image:

somewhat different

Beyond risk sharing - we team up to create opportunities

Together with our customers and partners, we develop value-creating and innovative solutions that deliver lasting protection for companies and individuals worldwide against risk.

Responsibility, we-spirit and drive

are our success factors. Our shared values are the basis for our partnership-based business approach and our long-standing client relationships.

More