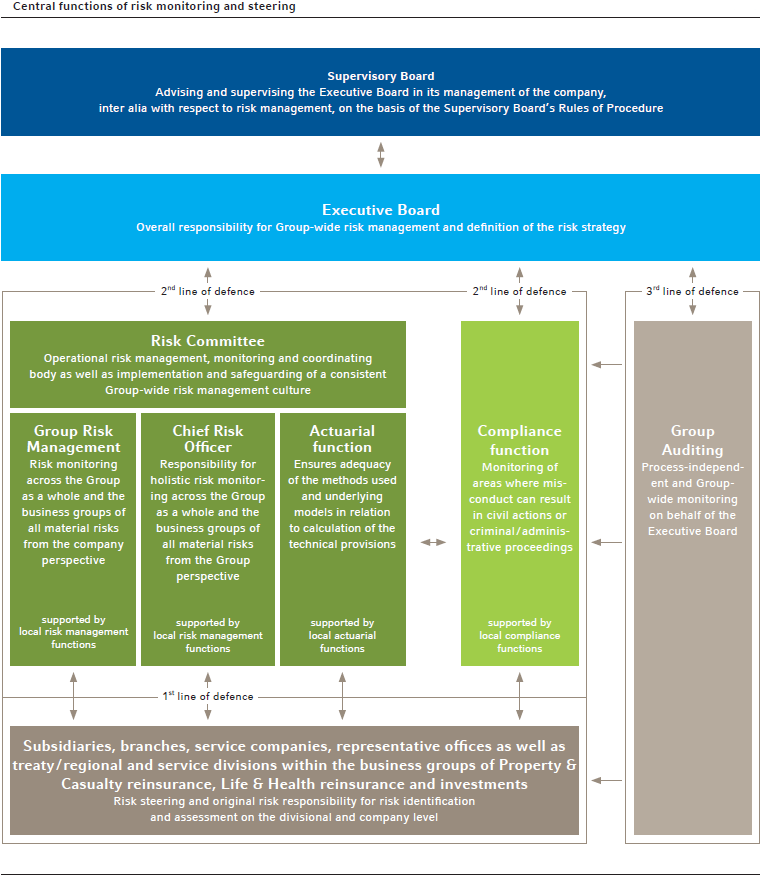

Hannover Re has set up risk management functions and bodies Group-wide to safeguard an efficient risk management system. The organisation and interplay of the individual functions in risk management are crucial to our internal risk steering and control system. The central functions of risk management are closely interlinked in our system and the roles, tasks and reporting channels are clearly defined and documented in terms of the so-called “3 lines of defence”. The first line of defence consists of risk steering and the original risk responsibility on the divisional or company level. The second line of defence consists of the core functions of risk management, the actuarial function and the compliance function. These units are responsible for monitoring and control. The third line of defence is the process-independent monitoring performed by the internal audit function. The following chart provides an overview of the central functions and bodies within the overall system as well as of their major tasks and powers.

The risk management functions meet regularly, e. g. in the context of the Group Risk Management Meeting (GRiMM), in order to support Group-wide risk communication and establish an open risk culture.

More Information

Topic related links outside the report: